B2B Products

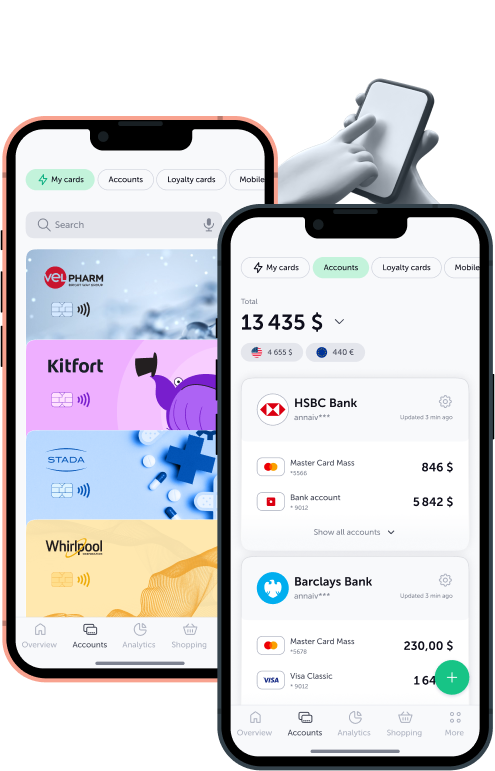

Banks

Data

Aggregation

your customers

Personalised

Banking

to everyone

Loyalty

Tech

cashback

Brands

Advertising

in banking channels

in bank services

Shopping

analytics

of a customer

Banking

loyalty cards

Treasurers

Aggregating bank

data for corporations

and statements across

the group to ERP, 1C, SAP

Testimonials

Back in 2018, Modulbank decided we wanted to convert the entire loan portfolio into automatically issued loan products that do not require any manual processing of a wealth of documentation. March this year saw the release of Modulcredit which adheres to the principle. This was largely possible thanks to CASHOFF's technology.

Anton Lipatov CFO ModulbankRetail is one of Novikom's most promising lines of business. Therefore we are in continuous search for new solutions that would spark interest among our customers. I'm convinced that item-based cashback will become an effective tool for the development of customer loyalty. Our colleagues at CASHOFF has developed technologies of data consolidation and enrichment all the way to e-receipts, as well as the AI, that bring the bank closer to every customer. "Smart Advice shapes a unique customer experience while PFM ensures the service is every user friendly, which we truly appreciate!

Evgeniy Gladilin Head of Retail Department at NovikombankThe service integration into the bank's mobile apps was fast and smooth. We have managed to enhance our app with new features as quickly as in one month after the implementation started thanks to the professionalism of CASHOFF's team.

Anton Turzhanskiy Deputy Head of Banking Systems Development and Support Unit at IT Infrastructure Department RRDBWith CASHOFF and the partnered brands, we are able to offer additional cashback on our customers' shopping routine. This is a win-win deal: the customers earn more rewards yet sticking to their habits and pay for their purchases with VTB bank cards; brands get exposure to the Multibonus marketplace and an opportunity to use direct marketing tools to promote their products among the banking audience, and the bank enjoys an enhanced loyalty program.

Roman Sinenko Head of the Multibonus loyalty program at VTBWe are offering a service that highlights customers' expense patterns and helps identify their needs. These data enable the customers to manage their family finances more effectively. We give hints as to how they can cut down on fees and save up more by connecting their near and dear to the family budget. We are working to increase financial awareness among our customers and find daily evidence that managing your budget together as a family is even more efficient.

Yulia Fomina Marketing Director at SBI bankThe Skrepka service comprises a mobile app, a lender's personal account, a settlement system between the lender and the borrower, the integration and security systems, and uses CASHOFF's technology of receipt recognition and brand-funded cashback rewarding. Our service plays its responsible part in society by helping people on low income to decrease their financial burden. We appeal to food and goods manufacturers, as every time the borrower purchases your item they will be reducing their debt. I am confident that this will be remembered and appreciated.

Alexey Shumilin Co-founder at FUNDWIZER Holding AG

Distinctions

Services Companies in UK

Innovation Award

Best Tech Companies in Asia

B2B Products

#01

Data

Aggregation

about your customers

#02

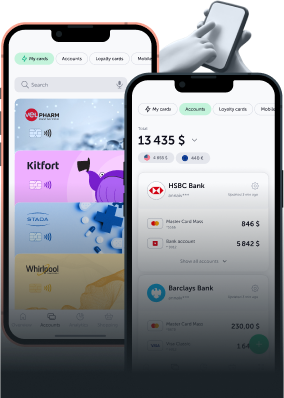

Personalised

Banking

to everyone

#03

Loyalty

Tech

cashback

#04

Advertising

in banking channels

in bank services

#05

Shopping

analytics

of a customer

#06

Banking

loyalty cards

to consumers

#07

Aggregating bank

data for corporations

across the group to ERP, 1C, SAP

Testimonials

Introducing banking data aggregation for our business customers is yet another step on Otkritie's journey towards open banking environment. Thanks to the financial innovations, we are now able to offer a brand-new service to our customers, including more affordable loans and convenient multi-banking.

Nadezda Dubikova PO at Online Business Development Department in OtkritieBack in 2018, Modulbank decided we wanted to convert the entire loan portfolio into automatically issued loan products that do not require any manual processing of a wealth of documentation. March this year saw the release of Modulcredit which adheres to the principle. This was largely possible thanks to CASHOFF's technology.

Anton Lipatov CFO ModulbankRetail is one of Novikom's most promising lines of business. Therefore we are in continuous search for new solutions that would spark interest among our customers. I'm convinced that item-based cashback will become an effective tool for the development of customer loyalty. Our colleagues at CASHOFF has developed technologies of data consolidation and enrichment all the way to e-receipts, as well as the AI, that bring the bank closer to every customer. "Smart Advice shapes a unique customer experience while PFM ensures the service is every user friendly, which we truly appreciate!

Evgeniy Gladilin Head of Retail Department at NovikombankThe service integration into the bank's mobile apps was fast and smooth. We have managed to enhance our app with new features as quickly as in one month after the implementation started thanks to the professionalism of CASHOFF's team.

Anton Turzhanskiy Deputy Head of Banking Systems Development and Support Unit at IT Infrastructure Department RRDBWith CASHOFF and the partnered brands, we are able to offer additional cashback on our customers' shopping routine. This is a win-win deal: the customers earn more rewards yet sticking to their habits and pay for their purchases with VTB bank cards; brands get exposure to the Multibonus marketplace and an opportunity to use direct marketing tools to promote their products among the banking audience, and the bank enjoys an enhanced loyalty program.

Roman Sinenko Head of the Multibonus loyalty program at VTBWe are offering a service that highlights customers' expense patterns and helps identify their needs. These data enable the customers to manage their family finances more effectively. We give hints as to how they can cut down on fees and save up more by connecting their near and dear to the family budget. We are working to increase financial awareness among our customers and find daily evidence that managing your budget together as a family is even more efficient.

Yulia Fomina Marketing Director at SBI bankThe Skrepka service comprises a mobile app, a lender's personal account, a settlement system between the lender and the borrower, the integration and security systems, and uses CASHOFF's technology of receipt recognition and brand-funded cashback rewarding. Our service plays its responsible part in society by helping people on low income to decrease their financial burden. We appeal to food and goods manufacturers, as every time the borrower purchases your item they will be reducing their debt. I am confident that this will be remembered and appreciated.

Alexey Shumilin Co-founder at FUNDWIZER Holding AGDistinctions

Companies Award

Services Companies in UK

Innovation Award

Best Tech Companies in Asia

We are here

to help

your project

Introducing banking data aggregation for our business customers is yet another step on Otkritie's journey towards open banking environment. Thanks to the financial innovations, we are now able to offer a brand-new service to our customers, including more affordable loans and convenient multi-banking.

Nadezda Dubikova PO at Online Business Development Department in Otkritie